AI in Federal Employment: A New Era for Efficiency

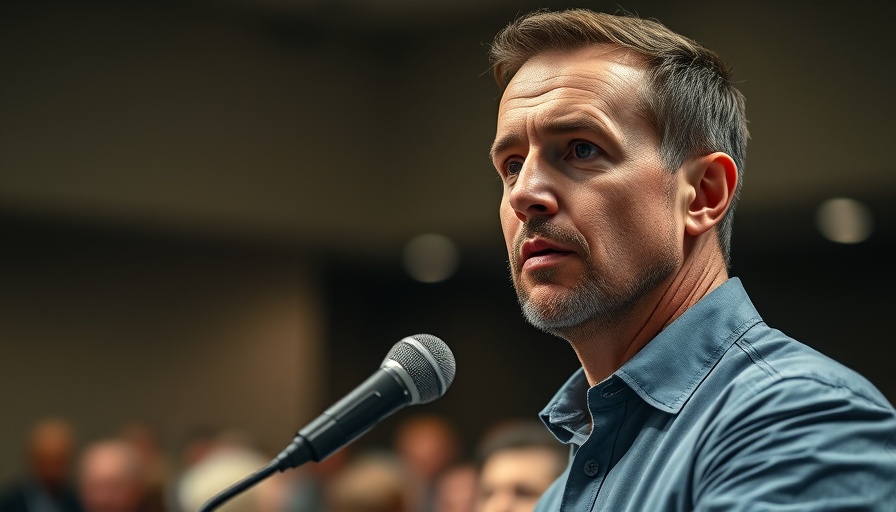

The Office of Personnel Management (OPM) is embarking on an ambitious journey to integrate artificial intelligence (AI) into its framework, aiming to boost efficiency amidst significant staff cuts. Under the leadership of Scott Kupor, the newly appointed director and a former venture capitalist, OPM is approaching these changes with a mindset reminiscent of Silicon Valley. He asserts, "AI is probably the most significant disinflationary technology that we have seen yet today." This statement reflects a transformative vision for government jobs, promising to enhance efficiency rather than merely replace human roles.

Understanding AI's Role: Efficiency Over Job Loss

Kupor emphasizes that AI will not cut jobs outright but will instead enhance existing roles by streamlining processes. This is particularly relevant given OPM's current trajectory to reduce its workforce from approximately 3,110 to around 2,000 employees—a one-third reduction by the end of the year. As agencies like the VA and DOJ already utilize AI to improve services, OPM's shift towards technology adoption is part of a broader trend influencing public sector operations.

Impacts on Employment: Grappling with the Future

As the landscape of employment continues to evolve, the integration of AI in federal agencies poses both opportunities and challenges. Kupor acknowledges that the workforce over the next decade will require different skill sets, urging OPM employees to be prepared for a tech-forward future. Buying into this vision encourages the workforce to think creatively about how they can adapt and thrive amid technological advancements. He remains optimistic that AI can create new job opportunities, a sentiment echoed by various sectors looking to innovate and scale their services.

Beyond Efficiency: The Bigger Picture of AI Integration

This strategy is not solely about cutting costs; it encompasses a vision of a new operational paradigm for government entities. For example, OPM is exploring using AI for tasks like customer service inquiries and analyzing the vast number of public comments they receive. The improvements are not simply about numbers—they're about enhancing the quality of service provided to citizens. With AI toolsets, agencies can process information more effectively, reducing human error and improving the user experience.

AI Innovations from Other Agencies

The Department of Veterans Affairs uses AI to standardize healthcare provisions, while the Department of Justice leverages it to gain insights into the drug market—illustrating the diverse applications of AI in government. As more agencies adopt similar models, the public sector can become more responsive and proactive, paving the way for efficient governance that benefits society as a whole.

Community Reactions: What This Means Locally

As OPM moves towards a tech-centric approach, community members might experience mixed emotions about changes in government employment. While some might fear job displacement, others could see the potential for enhanced services. Local workforce initiatives may need to pivot to prepare residents for the changing job market, fostering resilience amongst those affected by layoffs.

Conclusion: Embracing Transition through AI

Scott Kupor's vision for OPM signifies a pivotal moment in how government agencies interact with technology. As AI becomes woven into the fabric of public administration, it’s vital that employees and communities alike recognize the opportunities this transition brings. By adapting to change and embracing the technology at hand, both government workers and citizens stand to benefit from a more efficient, responsive, and innovative public sector. Encouraging open conversations on AI's role in the workplace will be essential for fostering a collective understanding as this narrative unfolds.

Add Row

Add Row  Add

Add

Write A Comment